Introduction

Saudi Arabia’s Thirst for Sustainable Growth

Why 2025 Marks a Turning Point for the Bottled Water Industry

Key Factors Driving Investment in Water Bottling Lines

What Saudi Investors Look for in Water Bottling Line Partners

Spotlight: PESTOPACK MACHINERY

Cost Breakdown of a Typical Water Bottling Line in Saudi Arabia

Local Market Opportunities and Competitive Edge

Environmental Impact and Sustainable Bottling Solutions

How to Build a Profitable Water Bottling Plant in Saudi Arabia

Future Outlook: Where the Saudi Water Industry Is Headed

Conclusion

Introduction

Saudi Arabia is entering a golden era of industrial diversification — and one of the fastest-growing sectors is water bottling lines. Driven by population growth, climate challenges, and changing lifestyles, investors are increasingly turning their attention to modern bottled water production as a sustainable and profitable venture.

The year 2025 is expected to mark a major acceleration in Saudi Arabia’s bottled water industry. From small entrepreneurs to industrial groups, everyone wants a piece of the action. Let’s dive into what’s behind this surge — and why manufacturers like PESTOPACK MACHINERY from China have become strategic partners in helping investors achieve success.

Saudi Arabia’s Thirst for Sustainable Growth

The Desert Economy and the Demand for Packaged Water

Saudi Arabia’s geography defines its market dynamics. With scarce freshwater sources and an arid environment, the need for purified and packaged drinking water has never been greater. Local consumers increasingly rely on bottled water for both home and on-the-go consumption.

Changing Consumer Habits in a Hot Climate

Rising health awareness, tourism, and hospitality expansion have reshaped consumer behavior. Saudis are shifting from sugary drinks toward healthier hydration options, creating continuous demand for premium bottled and mineral water products.

Why 2025 Marks a Turning Point for the Bottled Water Industry

Vision 2030 and the Push for Industrial Diversification

Under Vision 2030, the Saudi government aims to diversify its economy and strengthen non-oil sectors. Water bottling fits perfectly within this framework — combining sustainability, job creation, and domestic production.

Rising Population and Tourism Demand

By 2025, Saudi Arabia’s population is expected to exceed 37 million, alongside a booming tourism sector. The increase in religious pilgrims, business travelers, and international tourists is fueling steady growth in bottled water consumption across hotels, airports, and retail stores.

The Government’s Environmental and Industrial Initiatives

The Public Investment Fund (PIF) and Ministry of Industry are supporting sustainable manufacturing models. Incentives include reduced import duties for eco-friendly equipment, financing for new production lines, and infrastructure support for local factories.

Key Factors Driving Investment in Water Bottling Lines

Technological Advancements in Bottling Equipment

Modern water filling machines are far more efficient than their predecessors. From rotary rinsing-filling-capping units to advanced CIP cleaning systems, investors can achieve higher productivity with lower energy and water consumption.

Cost Efficiency and Automation Benefits

Automation has become a decisive factor for Saudi investors. Fully automatic lines reduce manpower requirements while maintaining consistent filling accuracy. Smart PLC control systems ensure real-time monitoring, helping operators optimize production output.

Local Market Expansion and Export Potential

The GCC and North African markets are increasingly interconnected. Investors can now produce bottled water domestically and export regionally, benefiting from free trade zones and shared logistics routes via Jeddah, Dammam, and Riyadh.

What Saudi Investors Look for in Water Bottling Line Partners

Reliability, After-Sales Service, and Certification

Investors prefer manufacturers that offer ISO and CE-certified machinery, ensuring quality and compliance with local standards. Reliable after-sales support is crucial for maintaining uptime and protecting the return on investment.

Turnkey Solutions and Integration Capability

Saudi entrepreneurs are seeking partners who can deliver turnkey systems — from water treatment to labeling and packaging. Seamless integration between machines eliminates downtime and increases overall efficiency.

Transparent Pricing and Proven Performance

Factory-direct suppliers with transparent cost structures and proven references are increasingly preferred. This is where PESTOPACK MACHINERY stands out.

Spotlight: PESTOPACK MACHINERY

Factory-Direct Pricing and International Experience

Headquartered in Zhangjiagang, China, PESTOPACK MACHINERY is a leading manufacturer with over 20 years of experience in water and beverage equipment. By offering factory-direct pricing, PESTOPACK eliminates unnecessary middlemen, giving Saudi investors maximum value for their investment.

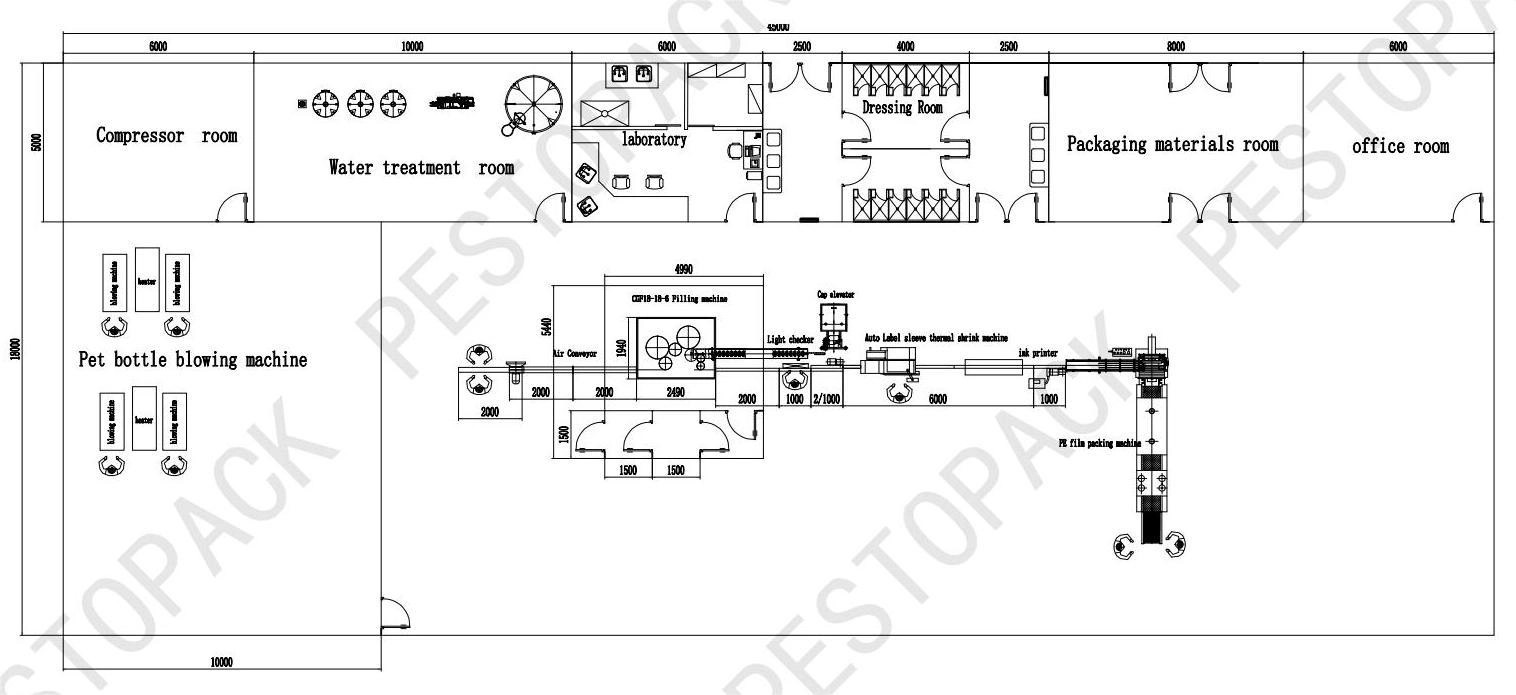

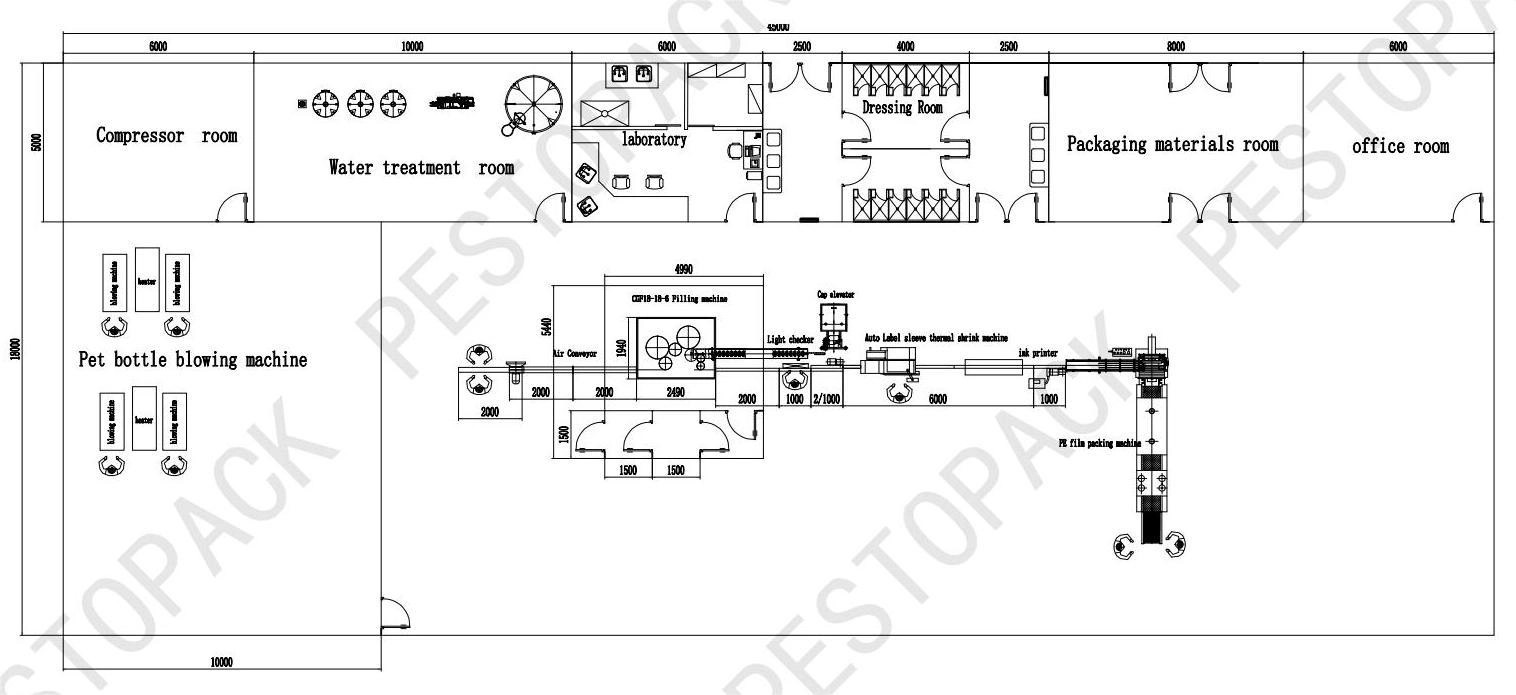

Full Range of Water Bottling Line Equipment

The company provides complete turnkey water bottling lines — including water treatment systems, blow molding machines, 3-in-1 filling machines, OPP or shrink labeling, date coding, and shrink wrapping. Every line is customized to meet local market conditions, bottle sizes, and capacity targets from 2000 BPH to 24 000 BPH.

Global After-Sales Service Network

PESTOPACK supports clients in over 30 countries with on-site installation, training, and spare-parts services. Their technical team offers remote assistance via video and software diagnostics — ensuring uninterrupted production for Saudi customers.

Cost Breakdown of a Typical Water Bottling Line in Saudi Arabia

Equipment Investment

The capital expenditure for a 6000 BPH complete line (including water treatment, blow molding, filling, labeling, and packaging) typically ranges between USD 250 000 and 400 000, depending on automation level and configuration.

Utilities and Operating Costs

Key operating costs include electricity (average 0.12 USD/kWh), water consumption, compressed air, and maintenance. Energy-efficient motors and compressors can reduce total operating costs by 15–20 %.

Labor, Maintenance, and Consumables

Automation reduces labor dependency to fewer than five operators per shift. Regular maintenance costs average 2–3 % of total equipment value per year, while consumables such as preforms, caps, and labels depend on packaging design and material quality.

Local Market Opportunities and Competitive Edge

High Profit Margins in the Premium Water Segment

Saudi consumers are embracing premium bottled water brands with distinctive packaging and mineral profiles. Entrepreneurs can target this growing niche by investing in high-clarity PET bottles and modern labeling technologies like OPP hot-melt systems.

Partnership Models for Saudi Entrepreneurs

Investors can collaborate with equipment suppliers for joint production or co-branding ventures. Leasing models and installment payment options are becoming common for new entrants seeking manageable start-up costs.

Environmental Impact and Sustainable Bottling Solutions

Energy Efficiency and Water Recovery Systems

New-generation bottling lines feature closed-loop rinsing, energy-saving servo drives, and air-recycling systems. These features not only cut costs but also align with Saudi Arabia’s sustainability goals.

PET Recycling and Lightweight Bottle Design

PESTOPACK encourages clients to adopt lightweight preforms and promote PET recycling. Reducing bottle weight by even 2 grams across millions of bottles translates into significant plastic savings and lower logistics costs.

How to Build a Profitable Water Bottling Plant in Saudi Arabia

Step-by-Step Setup Process

Conduct a water quality analysis to design the correct treatment system.

Select the suitable plant capacity (e.g., 4000 BPH, 8000 BPH, or 12 000 BPH).

Design the factory layout to ensure linear flow and hygiene compliance.

Procure the equipment package from a trusted supplier like PESTOPACK.

Install and commission the line under technical supervision.

Train local staff on operation, maintenance, and safety.

Regulatory and Quality Compliance

Bottled water plants must comply with the Saudi Food and Drug Authority (SFDA) and SASO standards, covering microbiological safety, labeling, and shelf-life requirements. Using CE-certified machinery simplifies approval procedures.

Marketing and Distribution Insights

Saudi Arabia’s distribution is dominated by supermarkets, convenience stores, and HORECA channels. Branding, design, and digital marketing — including QR-code traceability — help products stand out in a competitive landscape.

Future Outlook: Where the Saudi Water Industry Is Headed

Smart Bottling Technologies and IoT Integration

By 2025, the Saudi water sector will see more smart production lines integrated with sensors and IoT systems, enabling predictive maintenance, production analytics, and automated traceability.

Export Opportunities to GCC and Africa

With strong logistics and trade agreements, Saudi manufacturers can easily expand to neighboring GCC countries and North Africa, creating a regional supply hub for high-quality bottled water.

Conclusion: A Golden Era for Water Bottling Investors

As Saudi Arabia moves toward a diversified and sustainable economy, water bottling lines have emerged as one of the most promising investment avenues for 2025 and beyond. Low operational costs, strong market demand, and supportive industrial policies make this sector a magnet for both local and foreign investors.

By partnering with experienced manufacturers like PESTOPACK MACHINERY, Saudi entrepreneurs can build world-class bottling plants — backed by global expertise, factory-direct prices, and reliable service. The opportunity is crystal clear: invest in water, invest in the future.

English

العربية

Français

Русский

Español

Português

Tiếng Việt

ไทย

Polski

Türkçe

አማርኛ

ဗမာစာ

தமிழ்

Filipino

Bahasa Indonesia

magyar

Română

қазақ

हिन्दी

فارسی

Kiswahili

українська

Հայերեն

עברית

বাংলা

සිංහල

Oʻzbekcha

Azərbaycan dili

Български

ქართული

guarani

ગુજરાતી

Hausa

Igbo

ಕನ್ನಡ

Kinyarwanda

Kurdî

Кыргызча

Oluganda

മലയാളം

मराठी

Afaan Oromoo

ਪੰਜਾਬੀ

Runasimi

chiShona

Soomaali

Тоҷикӣ

తెలుగు

ትግንያውያን

Türkmençe

Yorùbá

isiZulu