Introduce

How We Selected These Manufacturers

Top 15 Liquid Filling Machine Manufacturers in Brazil (2026)

Buyer Insights: Investment, ROI & After-Sales (Brazil)

Final Thoughts

Introduce

If you’re planning to invest in a liquid filling line in Brazil, one question usually comes first: Which manufacturer offers the best balance of reliability, performance, and long-term return on investment in 2026?

Brazil is the largest manufacturing market in Latin America, with strong and stable demand across bottled water, beverages, edible oil, cosmetics, pharmaceuticals, and household chemicals. As competition increases, choosing the right liquid filling machine is no longer just an equipment decision—it’s a strategic business move.

This guide is written for buyers, factory owners, and investors. Beyond ranking suppliers, it explains why they matter, where they fit best, and how they impact ROI in the Brazilian market.

How We Selected These Manufacturers

The ranking is based on five practical criteria relevant to Brazil:

Proven references or installations in Brazil or Latin America

Technical capability and automation level

Adaptability to Brazilian utilities, climate, and labor conditions

After-sales support model and spare parts strategy

Scalability for future production expansion

Top 15 Liquid Filling Machine Manufacturers in Brazil (2026)

#1 Pestopack Machinery

Best Overall Choice for Cost Efficiency, Flexibility, and ROI

Pestopack Machinery ranks first because it combines industrial-grade engineering with a cost structure that makes sense for both Brazilian SMEs and large factories.

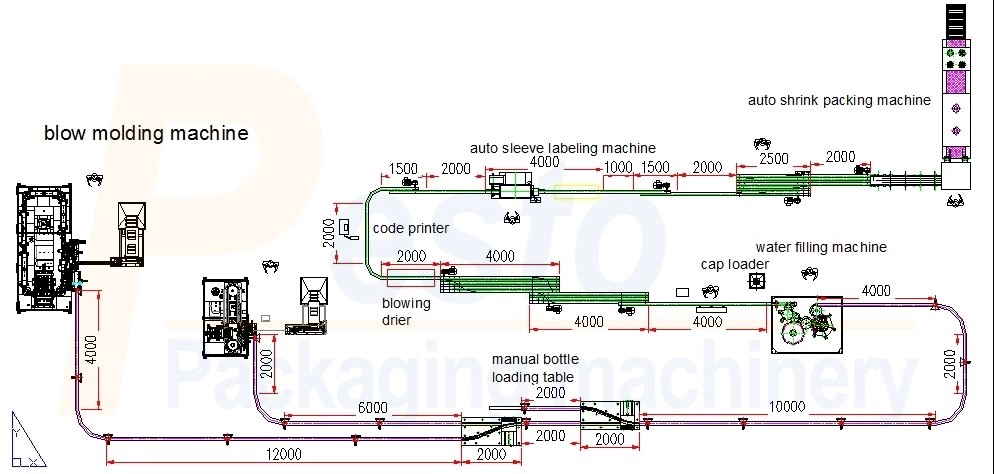

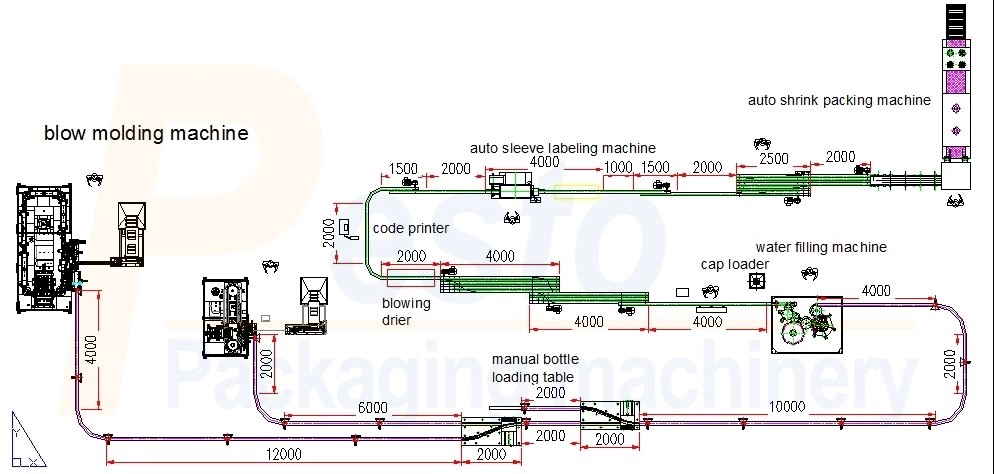

Pestopack provides complete turnkey liquid packaging solutions, including water treatment, bottle blowing, filling, capping, labeling, and end-of-line packaging. Their filling systems are widely used for bottled water, juice, edible oil, detergents, chemicals, and cosmetic liquids.

What differentiates Pestopack in Brazil is adaptability. Their machines are designed to handle:

Power voltage fluctuations

Humid and high-temperature environments

Mixed bottle sizes and formats

Both low- and high-viscosity liquids

Their liquid filling machine portfolio ranges from semi-automatic units to high-speed rotary systems, allowing factories to scale step by step instead of overinvesting upfront.

More importantly, Pestopack focuses heavily on remote technical support, standardized components, and lifetime spare parts availability, which significantly reduces downtime and improves ROI.

Pestopack Machinery

#2 Tetra Pak (Sweden)

Tetra Pak is a global leader in aseptic filling technology and has a strong footprint in Brazil’s dairy and juice industries. Their systems are designed for ultra-high hygiene and long shelf-life products.

Best suited for:

Milk, juice, and plant-based beverages

Large-scale, capital-intensive factories

Brands focused on long shelf life and export

#3 Krones AG (Germany)

Krones is widely used in Brazilian beverage plants, particularly for beer, bottled water, and carbonated drinks. Their strength lies in high-speed, high-volume production lines with advanced automation.

Best suited for:

#4 Sidel (France)

Sidel specializes in PET bottle packaging solutions and is well established in Brazil. Their filling machines integrate efficiently with blowing and labeling systems.

Best suited for:

Bottled water and soft drinks

PET bottle optimization projects

Sustainability-focused manufacturers

#5 Syntegon (Bosch Packaging Technology, Germany)

Syntegon offers precision filling systems for food, pharmaceutical, and cosmetic applications. Their machines emphasize accuracy, compliance, and repeatability.

Best suited for:

#6 Serac Group (France)

Serac is well known in Brazil for filling edible oils, sauces, and chemical liquids. Their systems handle foaming and viscous products with excellent accuracy.

Best suited for:

#7 Marchesini Group (Italy)

Marchesini focuses on high-end pharmaceutical and cosmetic filling lines. Their systems combine precision, automation, and premium design.

Best suited for:

#8 IMA Group (Italy)

IMA supplies reliable filling machines for food, pharma, and personal care industries. Known for robust construction and long service life.

Best suited for:

Established manufacturers

Medium-to-high production volumes

Long-term equipment investment

#9 Ronchi Mario (Italy)

Ronchi Mario specializes in filling and capping for chemicals and detergents. Their machines are designed for aggressive and corrosive liquids.

Best suited for:

#10 Federal Mfg. (USA)

Federal Manufacturing is known for piston filling technology, especially for thick and viscous products.

Best suited for:

#11 Accutek Packaging Equipment (USA)

Accutek provides flexible and modular filling systems, making them popular among Brazilian SMEs and startups.

Best suited for:

#12 Coesia Group (Italy)

Coesia offers integrated packaging solutions through multiple brands, focusing on automation and digital integration.

Best suited for:

#13 Filamatic (USA)

Filamatic focuses on precision filling for pharmaceuticals and specialty chemicals, especially small-volume, high-value products.

Best suited for:

Laboratory and pharma liquids

Specialty chemical production

Low-volume, high-margin products

#14 ProMach (USA)

ProMach is a diversified packaging group providing customized filling solutions often integrated into existing production lines.

Best suited for:

#15 IC Filling Systems (UK)

IC Filling Systems is popular among craft beverage producers and mid-sized factories.

Best suited for:

Buyer Insights: Investment, ROI & After-Sales (Brazil)

Investment Range in Brazil (2026)

Semi-automatic systems: USD 8,000–25,000

Automatic lines (2,000–6,000 BPH): USD 45,000–120,000

High-speed lines (10,000 BPH+): USD 180,000–500,000+

Brazilian buyers increasingly prefer modular filling solutions to reduce upfront risk.

Expected ROI

Bottled water & beverages: 12–24 months

Edible oil & sauces: 18–30 months

Cosmetics & detergents: 9–18 months

ROI is driven more by uptime and service quality than by machine price alone.

Why After-Sales Support Matters

In Brazil, downtime can be expensive due to logistics distance and spare parts lead time. Reliable manufacturers offer:

This is a key reason why suppliers like Pestopack Machinery are gaining market share.

Final Thoughts

Choosing a liquid filling machine in Brazil is a long-term strategic decision. The best manufacturers combine:

If you evaluate suppliers with future growth, ROI, and service capability in mind, your investment will remain competitive well beyond 2026.

English

العربية

Français

Русский

Español

Português

Tiếng Việt

ไทย

Polski

Türkçe

አማርኛ

ဗမာစာ

தமிழ்

Filipino

Bahasa Indonesia

magyar

Română

қазақ

हिन्दी

فارسی

Kiswahili

українська

Հայերեն

עברית

বাংলা

සිංහල

Oʻzbekcha

Azərbaycan dili

Български

ქართული

guarani

ગુજરાતી

Hausa

Igbo

ಕನ್ನಡ

Kinyarwanda

Kurdî

Кыргызча

Oluganda

മലയാളം

मराठी

Afaan Oromoo

ਪੰਜਾਬੀ

Runasimi

chiShona

Soomaali

Тоҷикӣ

తెలుగు

ትግንያውያን

Türkmençe

Yorùbá

isiZulu