Introduction

Why Bottled Water Consumption Is Growing Fast in Brazil

Key Factors Influencing Water Bottling Machine Price in Brazil

Water Bottling Machine Price in Brazil (2025 Updated)

Additional Costs Brazilian Investors Should Consider

Major Pain Points for Brazilian Investors — and How We Help

Recommended Line Configurations for Brazil (2025)

How to Reduce Total Investment Cost in Brazil

Why Brazilian Clients Choose PESTOPACK

FAQs – Water Bottling Machine Price in Brazil

Conclusion

Introduction

Brazil is one of the fastest-growing bottled water markets in Latin America, and demand in 2025 continues to rise rapidly. Investors are planning new bottled water plants, and existing factories are upgrading from 6,000 BPH to 12,000–20,000 BPH to reduce production cost per bottle.

One of the first questions every investor asks is simple:

“How much does a water bottling machine cost in Brazil in 2025?”

This guide provides updated pricing, investment insights, and professional recommendations tailored to Brazilian market needs. It includes water bottling machine price in Brazil, water filling machine Brazil, and turnkey bottled water plant Brazil.

Why Bottled Water Consumption Is Growing Fast in Brazil

Brazil’s bottled water demand continues to rise due to:

1. Urban residents relying on packaged drinking water

Major cities depend heavily on purified water for daily use.

2. Growing concern about water safety

More families choose bottled purified or mineral water for health reasons.

3. Strong expansion of supermarkets and private-label brands

Retail chains promote their own water brands, increasing demand for cost-efficient production lines.

Whether you're starting a new water bottling plant or upgrading to 12000–20000 BPH, the market offers strong investment opportunities—choosing the right machine at the right price is essential.

Key Factors Influencing Water Bottling Machine Price in Brazil

1. Production Capacity (BPH – Bottles Per Hour)

The biggest cost factor.

2000–3000 BPH → Entry-level small investment

6000–8000 BPH → Most popular for regional brands

12000–20000 BPH → Ideal for expansion

24000–36000 BPH → Industrial level competing with Minalba & Indaiá

2. Bottle Types Commonly Used in Brazil

Different bottle sizes require:

This affects total project cost.

3. Automation Level

Brazilian investors normally evaluate:

Semi-automatic (low cost, more labor)

Fully automatic complete water filling line (most balanced investment)

High-speed rotary systems for industrial factories

4. Material Quality & Anti-Corrosion Requirements

Due to Brazil’s humidity:

High-quality materials extend equipment lifetime and reduce maintenance cost.

5. Spare Parts Availability & Component Brands

Brazil prefers machines equipped with:

Siemens PLC

Schneider electricals

SMC pneumatics

ABB / Inovance servos

This ensures components are easily replaced locally.

6. Freight, Import Duty & Brazilian Taxes

Brazil import duties include:

II (Import Tax)

IPI

PIS/COFINS

ICMS

Optimizing HS Codes and documentation can lower costs by 10–25%.

Water Bottling Machine Price in Brazil (2025 Updated)

Based on CIF Santos / CIF São Paulo quotations.

Entry-Level 2000–3000 BPH Line

USD 45,000 – 75,000

Suitable for:

First-time investors

Small towns

Private-label brands

Typical configuration:

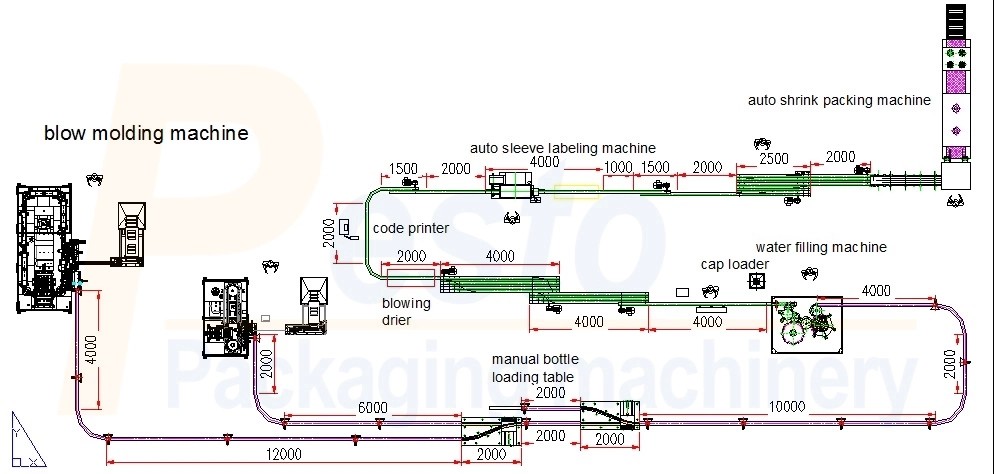

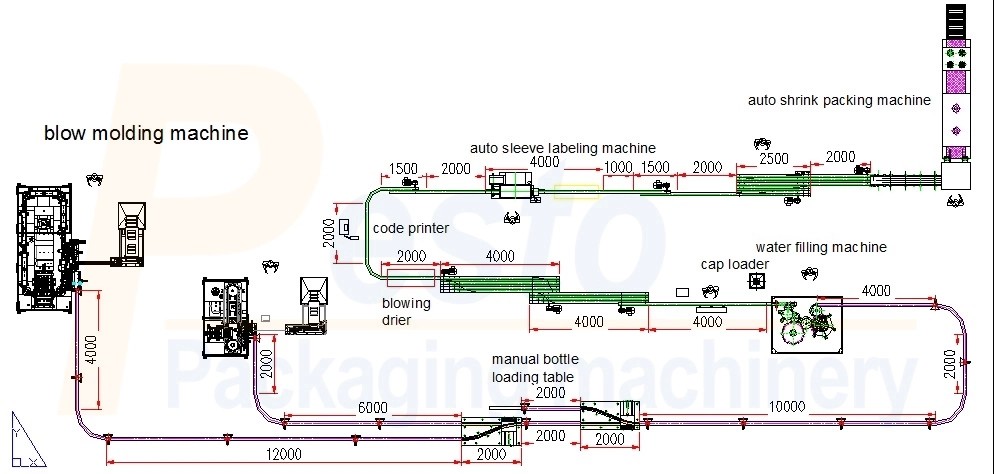

Medium 6000–8000 BPH Line

USD 120,000 – 180,000

Most popular in Brazil.

Includes:

Automatic bottle blowing machine

3-in-1 rinsing–filling–capping

Sleeve or OPP labeling

Shrink packer or carton packer

Optional complete water filling line expansion module

Large 12000–20000 BPH Water Bottling Line

USD 260,000 – 420,000

For expanding factories and regional distributors.

This level requires:

High-Speed 24000–36000 BPH Industrial Line

USD 550,000 – 1,200,000

For national-level brands such as:

Designed for fully automated, high-performance production.

Additional Costs Brazilian Investors Should Consider

1. Factory Space Requirements

2000–3000 BPH → 400–600 m²

6000–12000 BPH → 800–1200 m²

20000–36000 BPH → 1800–3000 m²

2. Water Treatment Requirements

Depending on local water characteristics:

Investors can link directly to water treatment system pages for further reference.

3. PET Bottle Blowing Cost (Brazil’s Preform Market)

Brazil has slightly higher preform prices; therefore, choosing an energy-saving automatic bottle blowing machine can reduce per-bottle cost by 15–20%.

4. Labor, Power & Operation Costs

Fully automatic bottling lines significantly reduce:

Labor costs

Machine downtime

Electricity consumption

Major Pain Points for Brazilian Investors — and How We Help

Pain Point 1: High Tax Burden

Pain Point 2: Uncertainty About Machine Quality

Siemens, Schneider, SMC, ABB, Inovance

Full stainless-steel structure

Pain Point 3: Weak After-Sales Support from Many Suppliers

Pain Point 4: Difficulty Calculating ROI

Recommended Line Configurations for Brazil (2025)

For New Investors

Recommended: 3000–6000 BPH complete water filling line

Why?

For Expanding Factories

Recommended: 12000–20000 BPH rotary water filling machine

Benefits:

How to Reduce Total Investment Cost in Brazil

Optimize factory layout (reduce construction cost by 10–15%)

Choose machines with universal spare parts

Use energy-saving pumps & compressors

Consider high-speed rotary systems for long-term ROI

Why Brazilian Clients Choose PESTOPACK

1. Full Turnkey Solutions

From water treatment system, automatic bottle blowing machine, filling, capping, labeling, to packing, PESTOPACK provides complete turnkey bottled water plant solutions.

2. Dedicated Brazil After-Sales Support

Portuguese communication

Remote support

Onsite installation

Spare parts availability

3. Successful Projects Across South America

Brazil

Chile

Argentina

Bolivia

Peru

FAQs – Water Bottling Machine Price in Brazil

Q1: What is the cheapest complete line in 2025?

A: USD 45,000–75,000 (2000–3000 BPH).

Q2: How long is installation?

15–25 days depending on capacity.

Q3: Which capacity offers best ROI in Brazil?

6000–12000 BPH.

Conclusion

The water bottling machine price in Brazil in 2025 ranges from USD 45,000 to USD 1.2 million+, depending on production capacity, automation, and machine configuration.

PESTOPACK provides turnkey bottled water plant solutions optimized for Brazilian market needs, with reliable engineering support and fast service.

For a CIF Santos / CIF São Paulo quotation tailored to your bottle size, water quality, and capacity target, feel free to contact us anytime.

English

العربية

Français

Русский

Español

Português

Tiếng Việt

ไทย

Polski

Türkçe

አማርኛ

ဗမာစာ

தமிழ்

Filipino

Bahasa Indonesia

magyar

Română

қазақ

हिन्दी

فارسی

Kiswahili

українська

Հայերեն

עברית

বাংলা

සිංහල

Oʻzbekcha

Azərbaycan dili

Български

ქართული

guarani

ગુજરાતી

Hausa

Igbo

ಕನ್ನಡ

Kinyarwanda

Kurdî

Кыргызча

Oluganda

മലയാളം

मराठी

Afaan Oromoo

ਪੰਜਾਬੀ

Runasimi

chiShona

Soomaali

Тоҷикӣ

తెలుగు

ትግንያውያን

Türkmençe

Yorùbá

isiZulu